Medical debt haunts millions of Americans, often lurking quietly until its effects become impossible to ignore. While most people expect health insurance to shield them from financial catastrophe, the reality is far harsher. Even insured families are vulnerable: a single emergency or chronic illness can set in motion a cascade of unpaid bills, savings depletion, and difficult trade-offs.

This article explores the profound toll medical debt takes on mental well-being, unpacking who is most affected, why the crisis persists, and how debt deepens emotional strain.

By examining the scope, causes, and hidden consequences of this debt burden, readers will better understand its impact and why it deserves urgent attention as both a financial and mental health crisis in the United States.

The Widespread Reach of Medical Debt in America

Medical debt is not an isolated issue affecting only the uninsured or chronically ill. Recent data show that about 20 million people (nearly one in twelve American adults) are dealing with significant medical debt. The problem is pervasive: 15% of households reported owing medical debt in 2021, and the aggregate amount owed nationally is estimated to be at least $220 billion.

Even among those with health insurance, unexpected deductibles, co-pays, and out-of-pocket costs quickly become unaffordable.

For many, a sudden diagnosis or accident initiates a cycle of debt that can last for years, impacting nearly every aspect of daily life. The challenge cuts across geography and income, affecting families from every walk of life.

Who Bears the Heaviest Burden—and Why

Not everyone faces the risk of medical debt equally. Adults facing health challenges or living with disabilities are more likely to struggle with unpaid medical bills.

For example, 13% of people with disabilities report owing medical debt, compared to just 6% without disabilities. Middle-aged adults, particularly those between 50 and 64, are more likely to carry this burden than younger or older adults.

Significant disparities also exist along racial and gender lines; 13% of Black Americans and 9% of women report medical debt, higher than the rates among White Americans or men. These differences reflect the intersection of health, income, and access, leaving already vulnerable populations exposed to even greater risk.

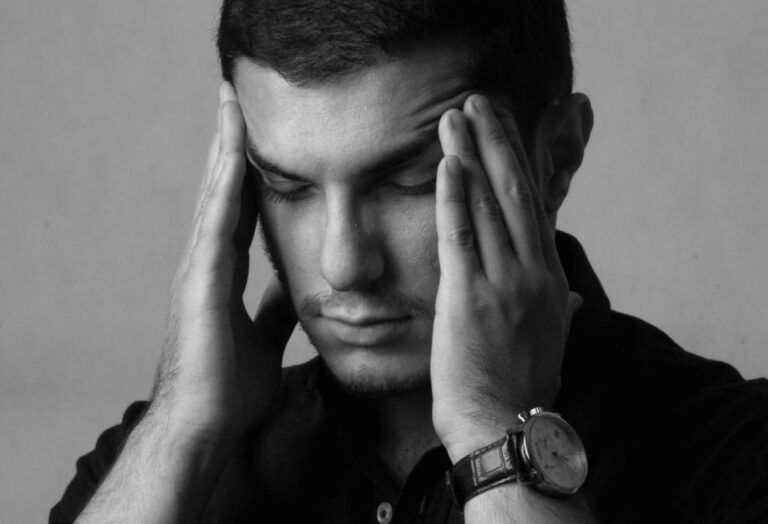

When Financial Strain Turns Emotional

For many, the effects of medical debt extend far beyond dollars and cents. Research shows a direct link between carrying unpaid medical bills and experiencing depression or anxiety. Among adults with a lifetime diagnosis of depression, nearly 20% report having medical debt, compared to 8.6% of those without such a history. The risk is even higher for people currently experiencing depression or anxiety; more than a quarter of these individuals also carry medical debt.

The relentless pressure to pay, the uncertainty about future care, and the persistent calls from collectors create an environment of chronic stress. Over time, this emotional strain can undermine relationships, reduce work productivity, and exacerbate existing health challenges.

Read More: 5-4-3-2-1 Coping Technique for Anxiety: A Great Method to Calm Your Anxiety

Delayed and Abandoned Mental Health Care

Medical debt doesn’t just damage mental well-being; it also blocks access to treatment. Adults with unpaid bills are significantly more likely to delay or skip care for depression and anxiety. Studies show that medical debt doubles the likelihood of postponing mental health visits and increases the chance of abandoning treatment altogether.

This association holds true even when accounting for factors like income or insurance coverage. The cycle is self-perpetuating: financial distress worsens mental health, yet the cost barrier prevents individuals from accessing the support they need. The gap between needing and receiving care grows, often with devastating long-term effects.

The Cascade of Hard Choices and Lasting Impact

The repercussions of medical debt ripple through every aspect of life. According to recent surveys, people with outstanding bills routinely cut spending on essentials like food and clothing, drain their savings, or borrow from friends and family. Some are forced to take on additional credit card debt just to keep up.

Even a small surprise bill can trigger this spiral, especially for those with little financial cushion. As debts accumulate, individuals may wonder what happens if you don’t pay medical bills. This situation can damage credit, increase stress, and further limit options for care or recovery. The consequences extend beyond immediate costs, negatively impacting future health and financial standing.

Systemic Gaps Fueling the Crisis

Despite widespread health insurance coverage, the U.S. healthcare system has characteristics that allow medical debt to flourish. High deductibles, out-of-pocket maximums, and limited coverage for certain services mean that even routine care can result in hefty bills.

Safety net programs and disability benefits often fail to keep up with the true cost of illness, especially for those with chronic or complex health needs. Disparities persist based on geography, race, and gender, compounding the effects for those already struggling.

The fact that insured and middle-income Americans remain at risk underscores that incremental reforms are insufficient; more comprehensive change is required to address the root causes of this silent crisis.

Toward Relief: Rethinking Debt and Well-Being

Addressing the intertwined challenges of medical debt and mental health requires new thinking, both individually and collectively. Policy solutions that cap out-of-pocket costs, strengthen safety nets, and improve insurance coverage could lessen the burden for millions. On a personal level, seeking help early, whether through financial counseling or mental health support, can break the cycle of distress before it deepens.

Greater awareness and advocacy are also vital, reducing stigma and shifting blame from individuals to systemic shortcomings. Recognizing medical debt as a public health issue, not just a financial problem, may be the crucial step toward building a healthier, more resilient society, one where access to care no longer comes at the cost of mental well-being.